Offshore Trust and Tax Planning – Minimize Risk and Enhance Protection

Offshore Trust and Tax Planning – Minimize Risk and Enhance Protection

Blog Article

Exploring the Advantages of an Offshore Trust for Wide Range Security and Estate Preparation

When it comes to protecting your riches and intending your estate, an overseas Trust can provide significant benefits. This strategic tool not only safeguards your possessions from lenders however likewise supplies personal privacy and potential tax obligation advantages. By comprehending just how these trust funds function, you can personalize them to fit your one-of-a-kind requirements and values. What particular factors should you think about when establishing one? Let's explore the key advantages and factors to consider that can affect your decision.

Understanding Offshore Trusts: Interpretation and Essentials

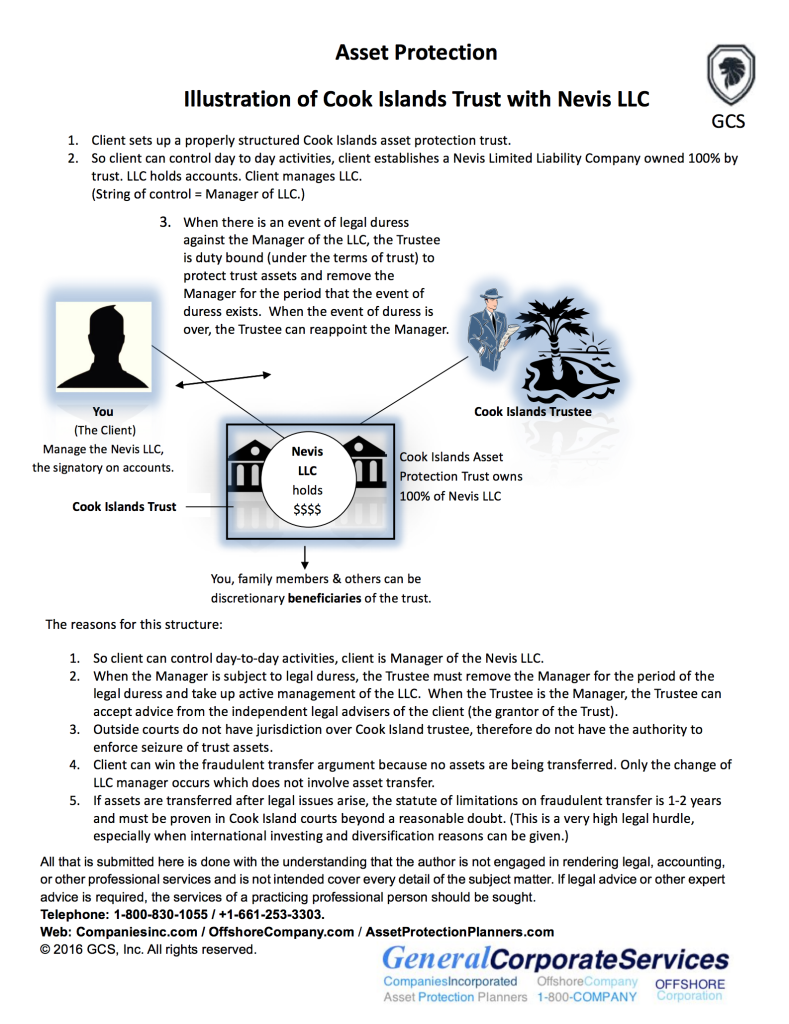

When you're exploring methods to protect your wide range, recognizing overseas counts on can be important. An overseas Trust is a lawful setup where you transfer your properties to a trust fund taken care of by a trustee in an international jurisdiction. This configuration supplies several advantages, including tax obligation benefits and improved personal privacy. You maintain control over the Trust while securing your assets from neighborhood lawful claims and prospective creditors.Typically, you would certainly develop the Trust in a territory that has positive laws, assuring more robust possession defense. This implies your riches can be shielded from claims or unexpected financial problems back home. It's important, however, to understand the legal effects and tax obligations entailed in handling an offshore Trust. Consulting with a monetary advisor or lawful specialist is wise, as they can lead you with the complexities and assurance compliance with global guidelines. With the right approach, an overseas Trust can be an effective tool for protecting your wealth.

Possession Security: Securing Your Wealth From Lenders

Understanding the legal framework of offshore depends on is essential when it comes to protecting your wealth from financial institutions. These trust funds supply significant advantages, such as enhanced privacy and confidentiality for your properties. By utilizing them, you can create a solid obstacle against potential claims on your wealth.

Legal Framework Benefits

While many individuals seek to grow their wide range, shielding those assets from potential creditors is equally crucial. An offshore Trust supplies a durable lawful structure that boosts your property security method. By developing your count on a jurisdiction with positive laws, you can effectively secure your riches from insurance claims and lawsuits. These territories usually have solid privacy regulations and restricted gain access to for outside celebrations, which implies your assets are much less at risk to financial institution activities. Additionally, the Trust structure gives legal separation between you and your properties, making it harder for creditors to reach them. This positive technique not only safeguards your riches yet also assures that your estate preparing objectives are fulfilled, enabling you to attend to your enjoyed ones without unnecessary risk.

Personal privacy and Confidentiality

Personal privacy and privacy play a pivotal function in asset protection methods, specifically when utilizing offshore depends on. By establishing an overseas Trust, you can maintain your monetary events very discreet and shield your properties from possible financial institutions. This implies your wealth stays much less accessible to those seeking to make insurance claims against you, offering an extra layer of safety. Additionally, numerous territories supply strong personal privacy laws, ensuring your details is shielded from public examination. With an overseas Trust, you can enjoy the peace of mind that comes from understanding your assets are secured while keeping your privacy. Eventually, this level of privacy not only safeguards your riches however additionally boosts your general estate planning method, permitting you to concentrate on what absolutely matters.

Tax Obligation Advantages: Leveraging International Tax Obligation Laws

You're not just safeguarding your assets; you're also touching right into worldwide tax obligation motivations that can significantly decrease your tax worry when you think about offshore trust funds. By tactically positioning your wealth in jurisdictions with desirable tax legislations, you can boost your asset defense and decrease estate tax obligations. This approach enables you to enjoy your wide range while guaranteeing it's guarded versus unexpected difficulties.

International Tax Obligation Incentives

As you check out offshore trust funds for wealth protection, you'll locate that worldwide tax incentives can substantially improve your monetary approach. Several jurisdictions offer beneficial tax obligation therapy for trusts, enabling you to decrease your total tax obligation problem. As an example, specific nations provide tax obligation exemptions or minimized rates on earnings produced within the Trust. By purposefully putting your assets in an overseas Trust, you may likewise take advantage of tax deferral choices, postponing tax obligation obligations until funds are taken out. Additionally, some territories have no capital gains tax obligations, which can further improve your financial investment returns. offshore trust. This suggests you can maximize your riches while decreasing tax obligation obligations, making global tax incentives an effective tool in your estate preparing toolbox

Property Security Approaches

Inheritance Tax Minimization

Establishing an overseas Trust not just shields your possessions however additionally provides considerable tax advantages, particularly in estate tax obligation minimization. By placing your wide range in an offshore Trust, you can benefit from positive tax laws in different territories. Many nations enforce lower inheritance tax rates or no inheritance tax in any way, enabling you to maintain more of your wide range for your beneficiaries. Additionally, given that assets in an overseas Trust aren't usually taken into consideration component of your estate, you can additionally minimize your inheritance tax liability. This strategic step can lead to considerable financial savings, making sure that your beneficiaries get the optimum benefit from your hard-earned wide range. Eventually, an overseas Trust can be a powerful tool for reliable inheritance tax planning.

Privacy and Confidentiality: Maintaining Your Financial Affairs Discreet

Estate Planning: Making Certain a Smooth Shift of Wide Range

Keeping personal privacy via an offshore Trust is just one facet of wide range administration; estate planning plays an important role in ensuring your assets are handed down according to your desires. Reliable estate planning permits you to describe exactly how your wide range will certainly be dispersed, minimizing the danger of family disagreements or legal obstacles. By plainly defining your purposes, you help your successors recognize their roles and responsibilities.Utilizing an offshore Trust can streamline the procedure, as it often gives you with a structured means to manage your assets. You can assign recipients, specify conditions for inheritance, and top article also outline particular usages for your wealth. This critical method not just protects your assets from possible creditors however additionally helps with a smoother adjustment throughout a challenging time. Eventually, a well-crafted estate plan can protect your tradition, offering you assurance web link that your loved ones will be looked after according to your dreams.

Adaptability and Control: Tailoring Your Depend Fit Your Needs

When it pertains to customizing your overseas Trust, versatility and control are key. You can tailor your depend fulfill your particular demands and choices, guaranteeing it straightens with your economic goals. This versatility enables you to make a decision exactly how and when your properties are dispersed, offering you assurance that your riches is taken care of according to your wishes.You can select recipients, established problems for circulations, and also mark a trustee who comprehends your vision. This degree of control assists safeguard your properties from possible threats, while additionally giving tax obligation benefits and estate preparation benefits.Moreover, you can readjust your Trust as your conditions transform-- whether it's adding brand-new beneficiaries, modifying terms, or addressing shifts in your monetary situation. By tailoring your overseas Trust, you not only protect your wealth yet also produce a long lasting legacy that mirrors your worths and goals.

Choosing the Right Territory: Variables to Think About for Your Offshore Trust

Choosing the right territory for your offshore Trust can considerably influence its performance and advantages. When considering alternatives, consider the political security and regulatory setting of the country. A steady jurisdiction decreases dangers associated with unexpected lawful changes.Next, examine tax ramifications. Some jurisdictions provide tax obligation incentives that can improve your wide range protection method. Furthermore, take into consideration the legal structure. A jurisdiction with strong property protection legislations can safeguard your possessions versus potential claims - offshore trust.You ought to likewise reflect on privacy laws. Some nations supply better confidentiality, which can be necessary for your satisfaction. Assess the ease of access of regional specialists that can assist you, as their expertise will certainly be important for managing the complexities of your Trust.

Frequently Asked Questions

What Are the Prices Connected With Developing an Offshore Trust?

When developing an offshore Trust, you'll run into prices like setup fees, ongoing management charges, lawful expenses, and potential tax obligation ramifications. It's vital to evaluate these costs against the advantages before making a decision.

How Can I Accessibility My Possessions Within an Offshore Trust?

To access your properties within an offshore Trust, you'll generally need to work with your trustee - offshore trust. They'll direct you through the process, guaranteeing compliance with guidelines while promoting your requests for withdrawals or circulations

Are Offshore Trusts Legal in My Nation?

You must inspect your nation's legislations concerning overseas counts on, as regulations differ. Lots of countries enable them, but it's important to understand the legal implications and tax obligation obligations to assure compliance and prevent potential concerns.

Can an Offshore Trust Aid in Divorce Proceedings?

Yes, an overseas Trust can possibly assist in separation procedures by shielding properties from being separated. It's vital to speak with a lawful expert to guarantee conformity with your neighborhood laws and policies.

What Happens to My Offshore Trust if I Adjustment Residency?

If you change residency, your offshore Trust might still continue to be undamaged, yet tax ramifications and legal factors to consider can differ. It's necessary to consult with an more info here expert to browse these modifications and assurance compliance with guidelines. An offshore Trust is a lawful setup where you move your properties to a trust fund managed by a trustee in an international territory. You preserve control over the Trust while protecting your possessions from neighborhood lawful cases and possible creditors.Typically, you 'd establish the Trust in a jurisdiction that has positive laws, guaranteeing more robust asset defense. Developing an overseas Trust not only safeguards your possessions however likewise supplies substantial tax benefits, particularly in estate tax minimization. By positioning your properties in an overseas Trust, you're not just safeguarding them from possible financial institutions yet likewise ensuring your financial information remains confidential.These trust funds operate under stringent privacy legislations that restrict the disclosure of your monetary details to third celebrations. You can maintain control over your wide range while appreciating a layer of privacy that residential counts on usually can not provide.Moreover, by using an overseas Trust, you can decrease the danger of identity burglary and undesirable scrutiny from economic establishments or tax authorities.

Report this page